Exceptional Real Estate. Exceptional People.

﹀

Welcome to TriBridge Residential

We believe exceptional real estate is cultivated by exceptional people. TriBridge Residential capitalizes on multifamily residential opportunities through the acquisition, investment, development, and management of our unique communities. Our diverse portfolio across the Southeastern U.S. ranges from urban to suburban, from garden-style to mid-rise, from historic conversion to new construction, and from conventional to mixed-use. TriBridge prides itself on its opportunistic business plans and creative structuring ability.

The Core of Our Company

TriBridge has built success with the experience of our diverse team, our knowledge of the real estate market, and our established network of industry relationships. Focusing on the Southeastern multifamily market, TriBridge Residential established a sterling reputation and solid financial returns with our boutique, hands-on approach. With a passion for people and a commitment to growth, we nourish partnerships, generate value, and deliver quality apartment homes to our residents – it’s what we do, and at TriBridge Residential, we do it remarkably well.

Real Results.

Real Growth.

Coming from well-connected Atlanta roots in 1955, our three original partners, Lee Walker, Steve Broome, and Michael Tompkins, worked together with the TriBridge family’s second generation to dramatically increase the company’s portfolio and expand its geographic focus to the Southeast region of the U.S. TriBridge Residential is a multigenerational company committed to growth, with a clear vision aimed at success, utilizing decades of experience through a multitude of real estate cycles to mitigate risk and maximize returns. At TriBridge Residential, the possibilities have never been greater – and we’re just getting started.

Track Record

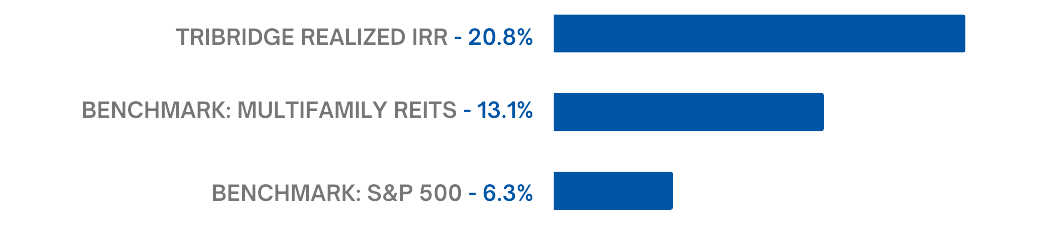

Cumulative Returns 1999-2024: TriBridge vs. Benchmarks

TriBridge seeks creative solutions to improve multifamily housing in the Southeast. Our company culture, which embraces drive and intellectual curiosity, enables us to provide exceptional multifamily investment, development, and management services and to capitalize on market opportunities.

Take a Peek at Our Portfolio

TriBridge Residential.

Reshaping Real Estate.